Federal Gift Limit 2025. The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. The individual and his or her spouse wish to split all gifts made by each other during the.

The lifetime gift tax limit for 2025 is $13.61 million, up from $12.91 million in 2025. The decision on alberta’s 2025 allocations represents a reversal of previous commitments by the federal government, and negatively impacts alberta’s ability to grow.

annual gift tax exclusion 2025 irs Trina Stack, For married couples, the limit is $18,000 each, for a total of $36,000. Individual, estate and gift taxes.

401k 2025 Contribution Limit Chart, In 2025, the federal estate tax limit and the gift tax limit will be changing. 2025 lifetime gift tax exemption limit:

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. A federal judge has ruled that a southern oregon city can't limit a local church's homeless meal.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. Individual, estate and gift taxes under the 2025 federal budget | lumsden mccormick cpa.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. In 2025, the federal estate tax limit and the gift tax limit will be changing.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, In 2025, the federal estate tax limit and the gift tax limit will be changing. You’ll have to report any gifts you give above.

The Maximum 401(k) Contribution Limit For 2025, The lifetime gift tax limit for 2025 is $13.61 million, up from $12.91 million in 2025. In 2025, the federal estate tax limit and the gift tax limit will be changing.

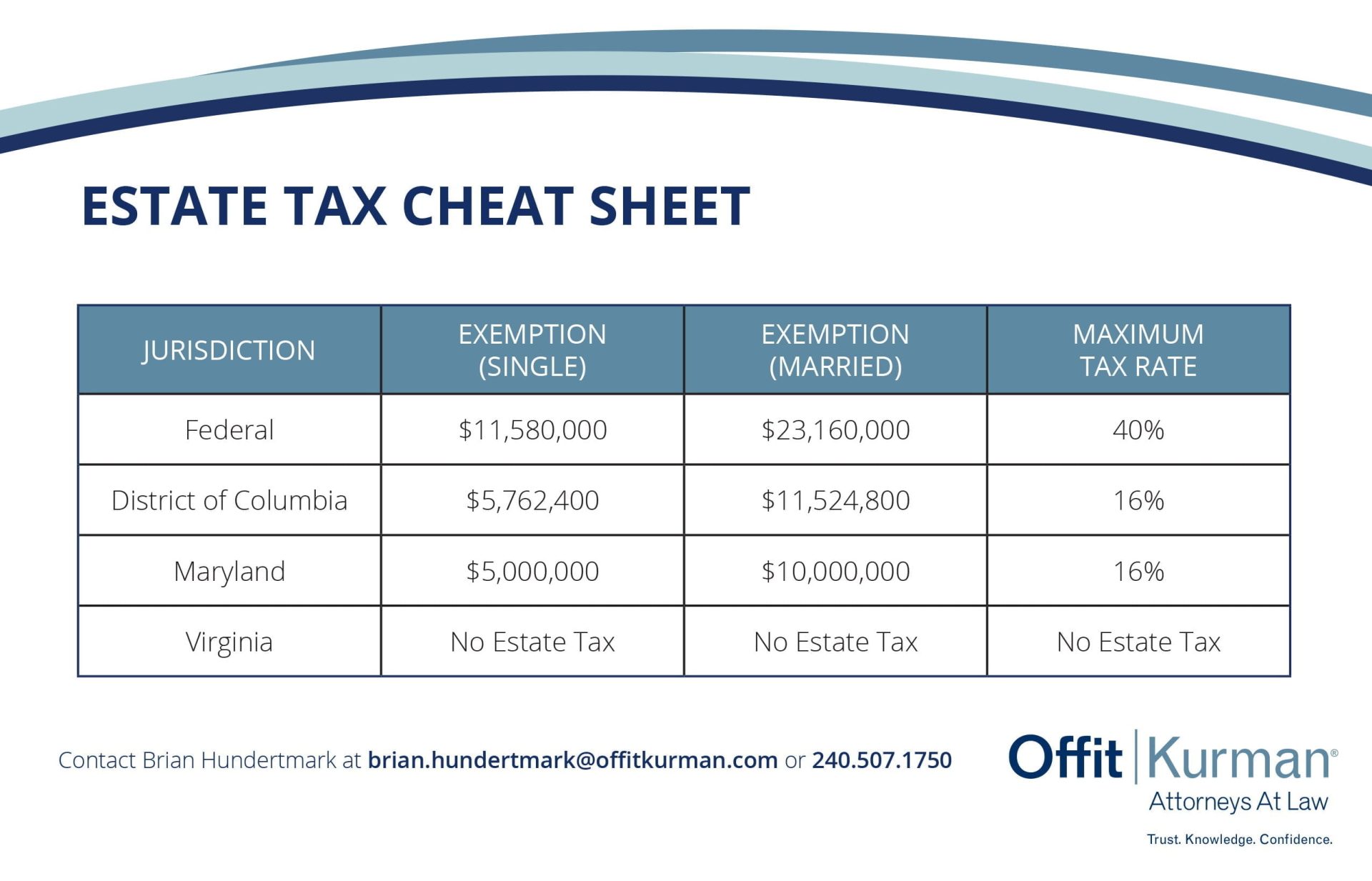

2025 Estate and Gift Taxes Offit Kurman, Individual, estate and gift taxes. This is up from $17,000 in 2025 and you never have to pay taxes on gifts that are.

Annual Gifting Limits 2025 Lynn Sondra, For married couples, the limit is $18,000 each, for a total of $36,000. What this does not mean is that any dollar above that $18,000 gift is taxable.

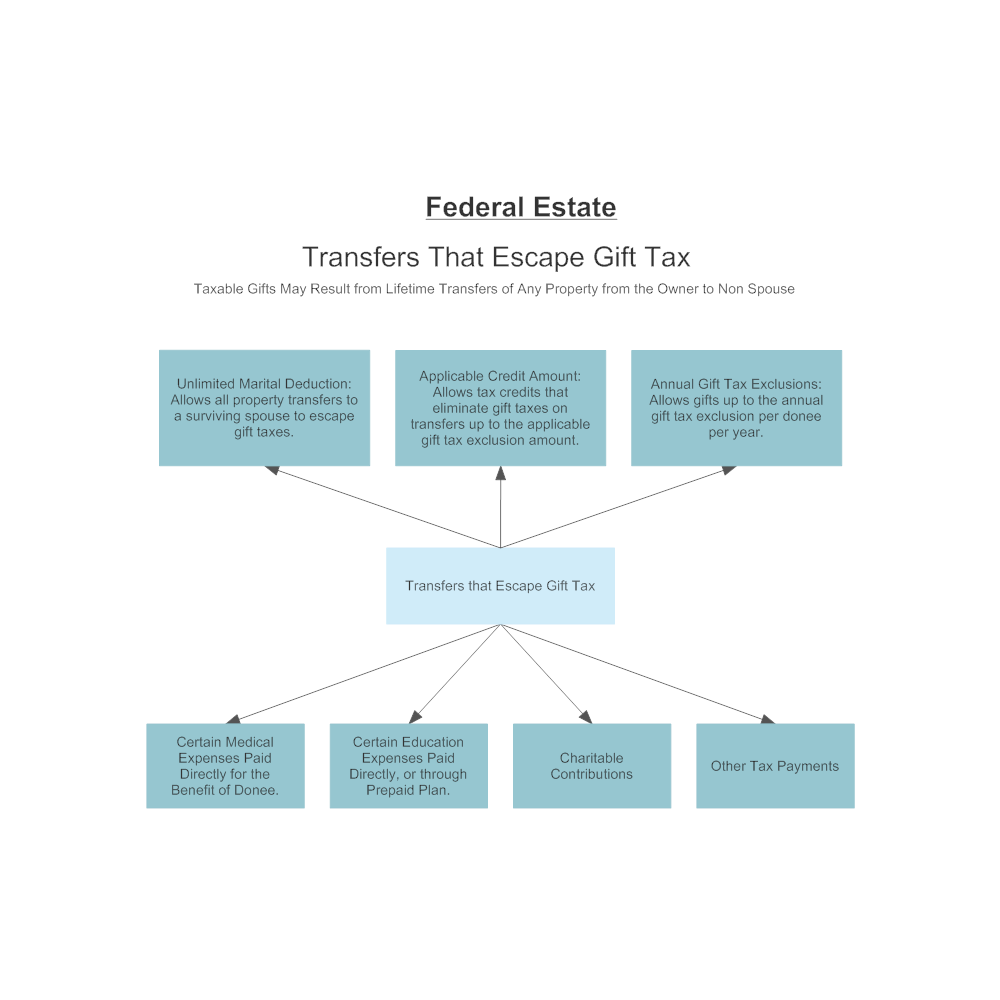

Federal Gift Tax Escapes, Estate and gift tax faqs | internal revenue service. These gifts can include cash as well as other.

The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.