401k Roth Contribution Limit 2025. In general, 401(k)s offer higher contribution limits than iras. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

These savings are subject to standard ira contribution limits. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift.

Roth IRA Contribution Limits 401(k) Plan Finance Strategists, 401 (k) contribution limits are increasing from $22,500 to $23,000 in. The contribution limit on 401(k) plans in 2025 is $23,000, with workers 50 and older allowed to set aside an additional $7,500 to catch up on retirement planning.

401k 2025 Contribution Limit Chart, This increase reflects a continued trend. The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50.

401(k) Contribution Limits for 2025, 2025, and Prior Years, The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. The irs has announced new contribution limits for retirement savings accounts in 2025.

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, In 2025, the limit was $6,500. These savings are subject to standard ira contribution limits.

The IRS just announced the 2025 401(k) and IRA contribution limits, You will be able to contribute an additional $500 in 2025. Anyone age 50 or over is eligible for an additional catch.

401(k) Contribution Limits in 2025 Meld Financial, And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older. Good news for 401 (k) and roth ira account owners:

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The maximum amount you can contribute to a roth 401 (k) for 2025 is $23,000 if you're younger than age 50. With contributions, you begin putting newly earned income into a roth ira each year.

The IRS announced its Roth IRA limits for 2025 Personal, Employees can contribute up to $23,000 to their 401 (k) plan for 2025 and $22,500 for 2025. The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's thrift savings plan is increased to $23,000, up from $22,500.

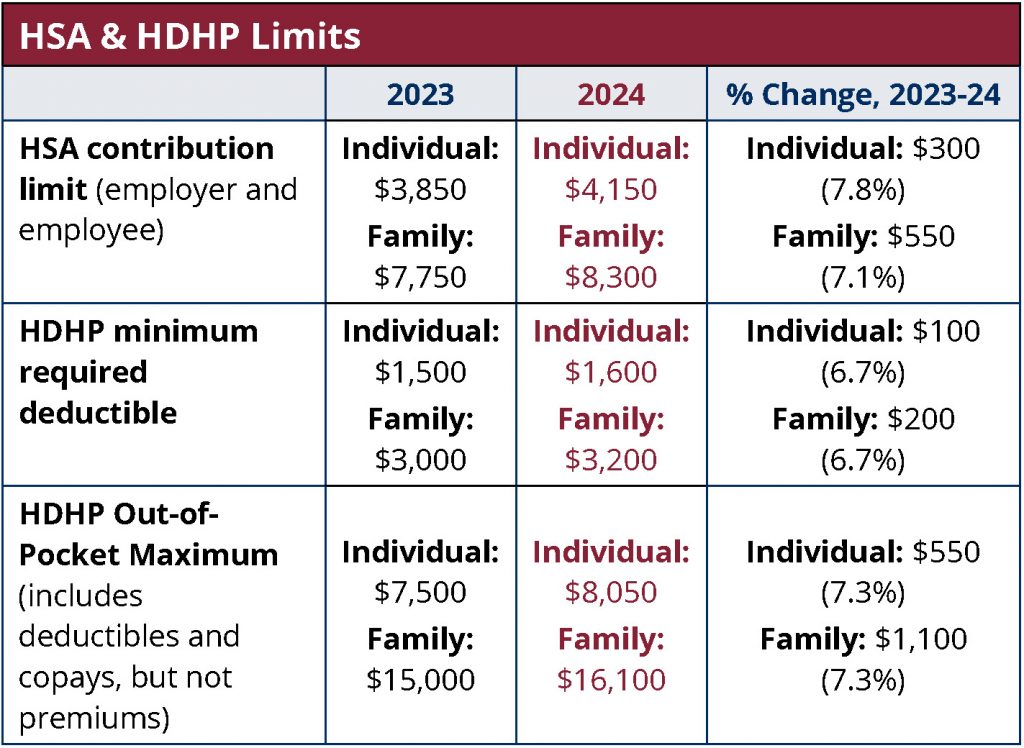

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, You may contribute additional elective salary deferrals of: And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older.

Infographics IRS Announces Revised Contribution Limits for 401(k), Employee contribution limits for roth 401(k)s are $22,500 for 2025, and $23,000 for 2025, the same as traditional 401(k)s. The irs has announced new contribution limits for retirement savings accounts in 2025.

The contribution limit on 401(k) plans in 2025 is $23,000, with workers 50 and older allowed to set aside an additional $7,500 to catch up on retirement planning.